But as soon as it turns into standard operating process, it has the potential of developing a more harmonious, more financially secure family. Have every member of the family make a list of his or her particular person wants. What may they need for a clothing allowance, for instance, and are they including soccer cleats or winter coats? What about movies, journeys to the skate rink and burgers with associates? Tell them to remember to be only as frugal as they’re realistically prepared to be.

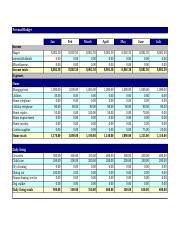

Find the Right Contractor – Getting a quote out of your building contractor is another piece of the construction price range puzzle. Finding a great contractor could be fraught with problem, so it’s essential to just remember to check the reviews and popularity of the contractors you might be contemplating. An easily generated and alterable estimate spreadsheet could make the budgeting course of easy and effective. Inputting the info from the construction quotes you have collected is made simple with a development estimating spreadsheet template. A spreadsheet template is a robust tool when coming up with a building estimation due to its flexibility and functionality. When you are looking for a budgetary format that allows you to shortly input and alter data for your building you possibly can’t go past an excel sheet.

Determine Why You Need A Finances

Have them discover cheap prices for each merchandise online and create a private monthly allowance. This would possibly take some time, so that you may wish to reconvene in per week or two. Explain that your family is spending more cash than it should.

Residential Development Price Range Spreadsheet

Structure an evidence of family goals that’s only as detailed because it must be. Instead of breaking insurance down into property, well being, life and residential, for instance, you would possibly simply put it underneath insurance and clarify that it needs to be paid. Show how much money is left over after rent, groceries, insurance, debt and education and all that that quantity is meant to cover.

You might need to construction your presentation of the finances a pair alternative ways for different aged children. If you have small youngsters, likelihood is their want to please and the opportunity to contribute to the “grownup” job of budgeting will carry them through with enthusiasm. With them, you might not want to enter the same detail of explaining the family funds. With older youngsters, it’s a good suggestion to offer them a head start on understanding how life works when you don’t make it as a rock star.